Instant asset write-off thresholds for small businesses that apply the simplified depreciation rulesĭate range for when asset first used or installed ready for use The thresholds have changed over recent years.

#Take the writedown full#

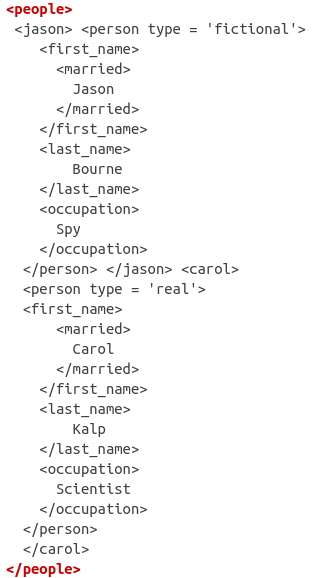

If temporary full expensing applies to the asset, you do not apply instant asset write-off. You are not eligible to use instant asset write-off on an asset if your aggregated turnover is $500 million or more. the cost of the asset being less than the threshold.when it was first used or installed ready for use.your aggregated turnover (the total ordinary income of your business and that of any associated businesses).EligibilityĮligibility to use instant asset write-off on an asset depends on: We have prepared a high-level snapshot to help you work out how these incentives may apply to you. first used or installed ready for use before 30 June 2021.įor the 2019––21 income years, eligible businesses may be able to deduct the cost of new depreciating assets at an accelerated rate using the backing business investment – accelerated depreciation rules.If temporary full expensing does not apply or you are not eligible for it, you may still claim the depreciation deduction under instant asset write-off if the asset was: You must immediately deduct the business portion of the asset's cost under temporary full expensing. The instant asset write-off does not apply for assets you start to hold, and first use (or have installed ready for use) for a taxable purpose, from 7:30pm (AEDT) on 6 October 2020 to 30 June 2023. There are 3 temporary tax depreciation incentives available to eligible businesses: You need to check your business's eligibility and apply the correct threshold amount depending on when the asset was purchased, first used or installed ready for use. The instant asset write-off eligibility criteria and threshold have changed over time. It cannot be used for assets that are excluded from those rules. If you are a small business, you need to apply the simplified depreciation rules to claim the instant asset write-off.

The move would not affect its 2019 full-year earnings before interest, tax, depreciation and amortization forecast on a business as usual basis, which it put at A$800 million to A$820 million last September. TPG said it expected the spectrum licenses and mobile network assets to complement the Vodafone network, but would take the writedowns as the proposed merger remains subject to approval. It will also reduce the value of its mobile network assets by A$76 million, and take other writedowns to the value of A$60 million. TPG, which is awaiting regulatory approval for a proposed merger with the Australian arm of Britain's Vodafone Group PLC, said it will reduce the value of its spectrum licenses by A$92 million. TPG said last month it had abandoned construction of the network because it relied on equipment from China's Huawei that has been banned by Australia's government on security grounds. (Reuters) - Australia's TPG Telecom Ltd said on Tuesday it will take A$228 million ($163 million) in writedowns in its first-half results after halting its mobile network rollout due to a ban on the use of equipment from Huawei Technologies Co Ltd.

0 kommentar(er)

0 kommentar(er)