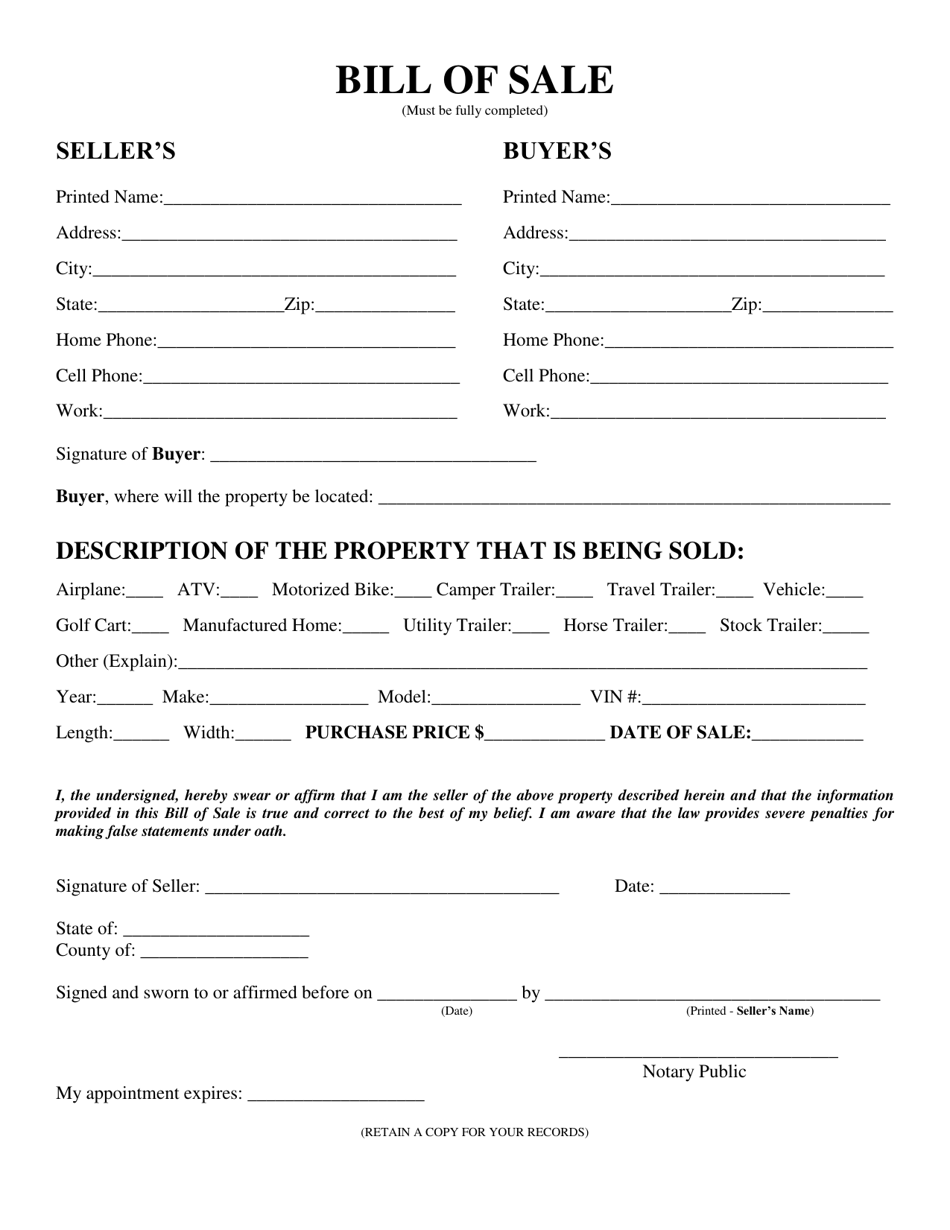

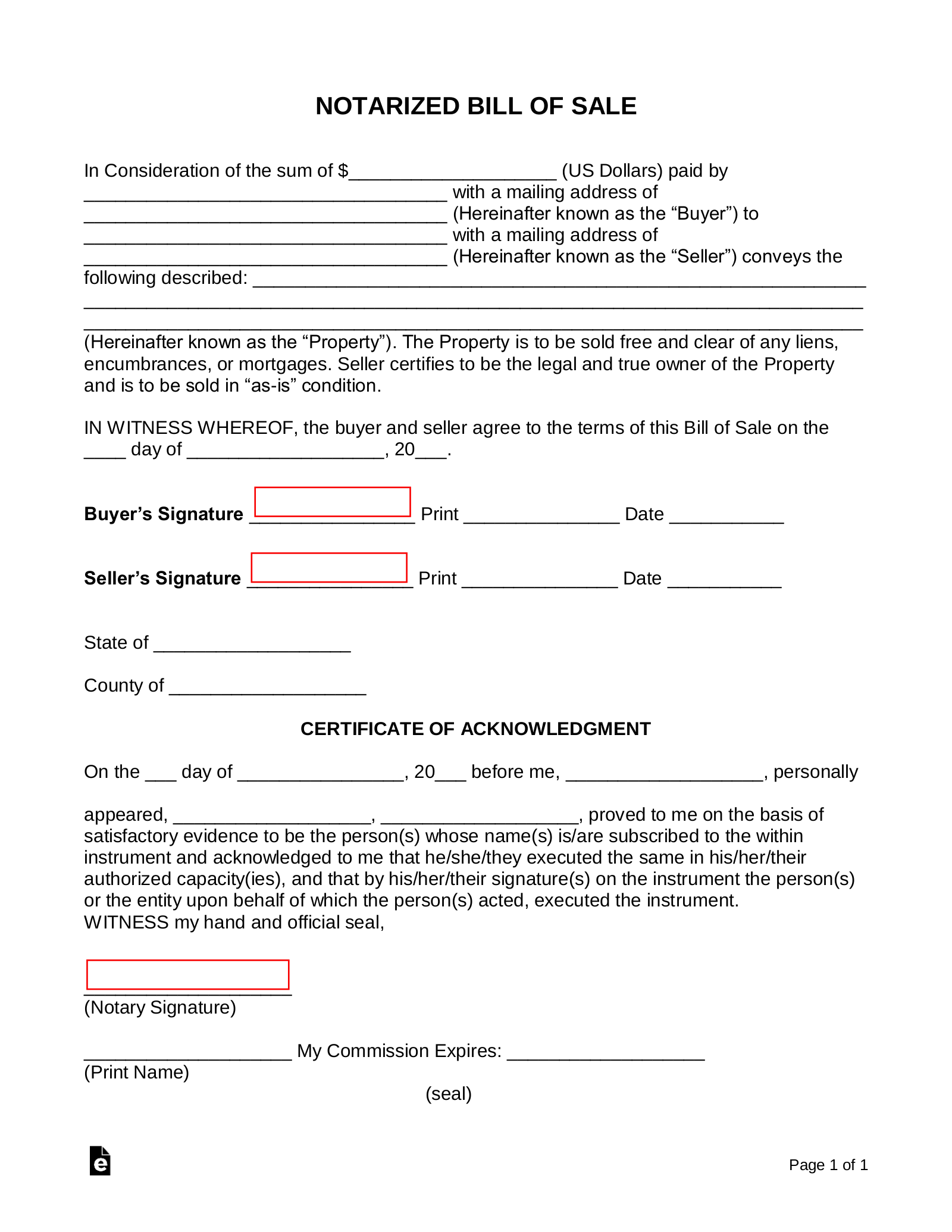

Submit a tax clearance on the real property.Īny manufactured home that is located on rental Mobile Home Park must pay into the manufactured home relocation fund.Submit a notarized bill of sale if the owner indicated on the Affidavit of Affixture has transferred ownership.Submit a lien clearance, if applicable.Submit a copy of the Affidavit of Affixture.Provide a written statement that the manufactured home is no longer affixed to the real property.To obtain a state inspection call 48 Option #5, Option #0.Have the manufactured home inspected to verify the vehicle identification number.Complete an application for Arizona Certificate of Title and Registration.Once an affixed manufactured home has been removed from the parcel that it was affixed to or has been sold separately from the land, you must re-title the manufactured home through motor vehicle. Year, make, size and vehicle identification number of manufactured home being moved.New owner or Dealer's name (if sold or traded in).

The required information needed to obtain this permit is:

The 504 tax clearance permit must be issued by the county that the manufactured / mobile home is currently located in. The assessor shall issue the clearance if it is determined that all fees and ad valorem taxes applicable to the manufactured / mobile home pursuant to title 42 have been paid as of the date of application. ARS 28-1104: A form 504 tax clearance permit is required by law when moving a mobile home.

0 kommentar(er)

0 kommentar(er)